Industry Context

The client emerged as the premier provider of mortgage services. As the industry evolved, it brought forth heightened demands for security compliance.

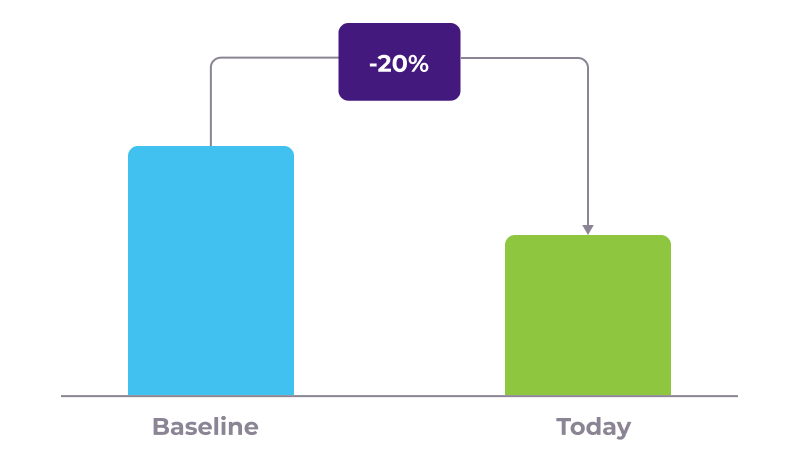

This shift highlighted the urgent need to modernize their enterprise loan system. The on-prem-based legacy application, initially designed to handle peak loads, soon revealed its drawbacks.

Not only did it lead to significant capacity wastage, but it also incurred unnecessary cost overheads. Azure presented the perfect solution to alleviate these challenges.